Your Principal Residence.

Canada Revenue Agency (CRA) Requirements.

In recent years, the Canada Revenue Agency (CRA) has required further disclosures when you sell your principal residence. Prior to 2016, the CRA required reporting, but the requirement was more honoured in the breach.

During 2016, the housing markets in Vancouver and Toronto exploded. Stories emerged of how people were taking steps to treat the disposal of their residence as eligible for the principal residence exemption.

The Ontario and BC governments took steps to calm the explosion, which they blamed on foreign buyers, by imposing new taxes on non-resident buyers and sellers. Meanwhile, if you’re over 65 the CRA introduced new penalties where sales of residences were not reported.

As a result, when you sell your personal residence, you are required to disclose the year that the property was purchased and the disposal proceeds in your tax return.

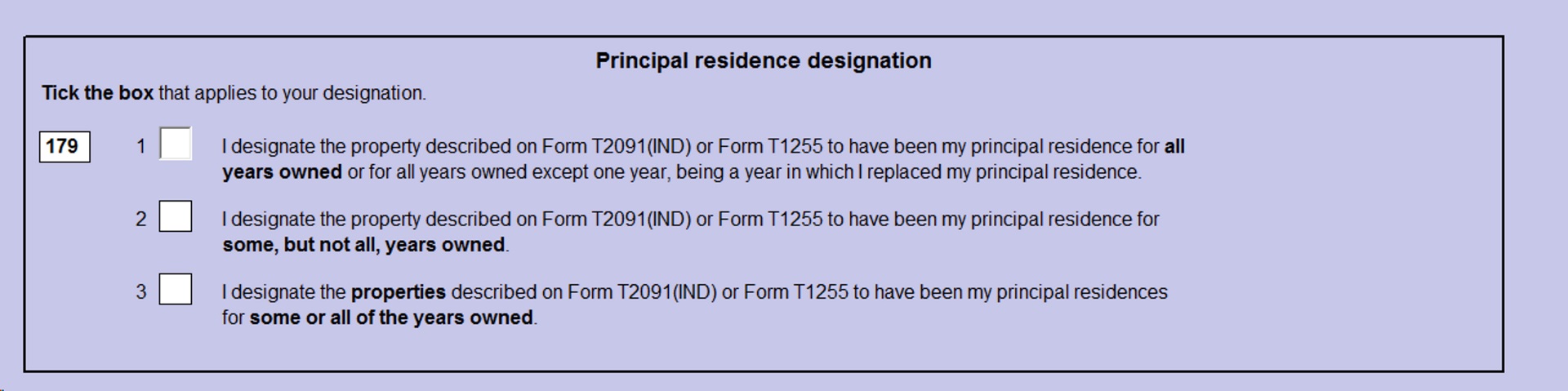

You also have to designate the number of years in which the property was your principal residence by selecting one of the following options:

CPP & Old Age Benefits

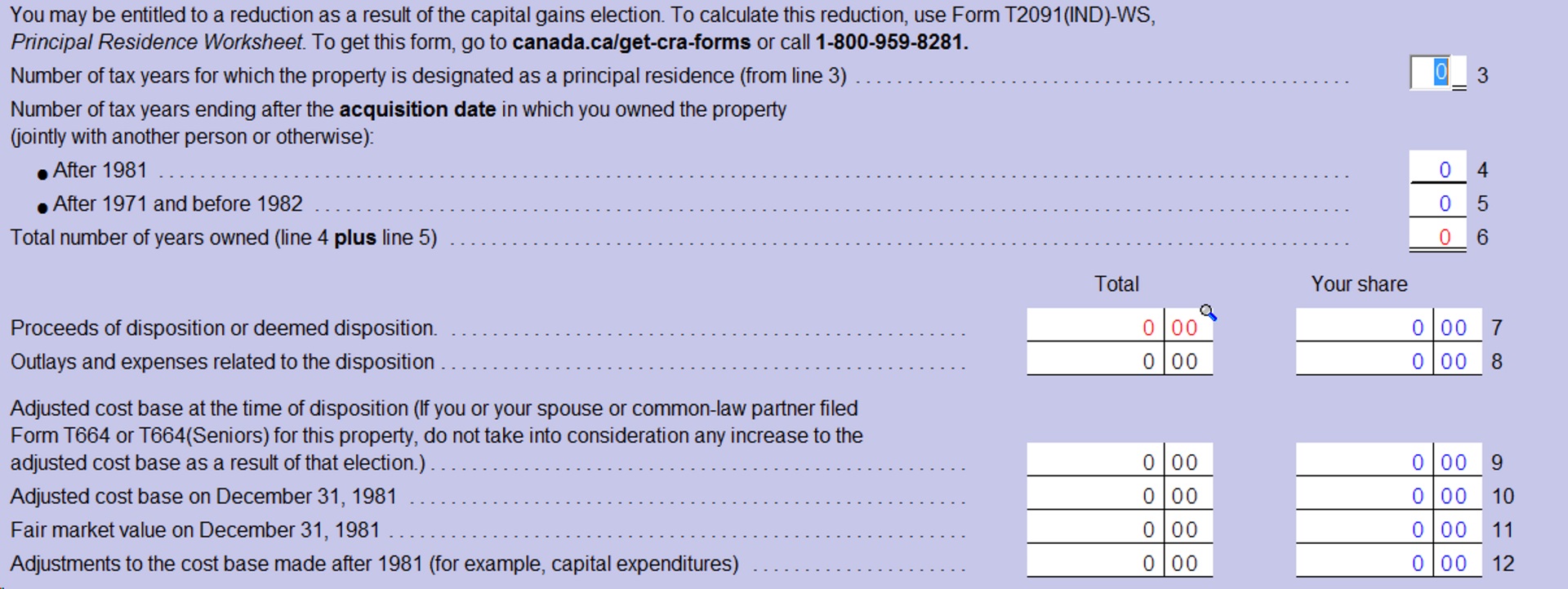

If the property was not your principal residence throughout the period of ownership, you have to designate the number of years that it was your principal residence between 1972 and 1982, and after 1981, in order to determine how much of the gain on sale of the property will be taxable.

The following information is required to calculate the gain:

As you can see, it is important to know the adjusted cost base of the property at the time that the property is sold. The adjusted cost base includes the original purchase costs (including legal fees and land transfer taxes) as well as the cost of capital improvements to the property following an acquisition. It does not include current expenses, such as repairs and maintenance and property taxes. The new reporting makes it even more important to keep copies of invoices related to capital improvements.

More to Consider

The other matter that you need to be aware of is whether an election was made in your 1994 tax return to deem the property to have been sold at the end of February 22, 1994, and to have immediately reacquired on February 23, 1994. Your ACB is usually the amount you designated as proceeds of disposition on Form T664 or T664 (Seniors), which was limited to $100,000 more than that the actual cost, as the election was to allow people to take advance of the lifetime capital gains election of $100,000 prior to this election being limited to the capital gain on the sale of qualifying small business shares and qualifying farm or fishing property.

As you can see, there are many issues to be dealt with when you sell your principal residence, so please ensure that you make us aware if you sell your residence in 2018, so we can report the sale properly in your 2018 tax return.